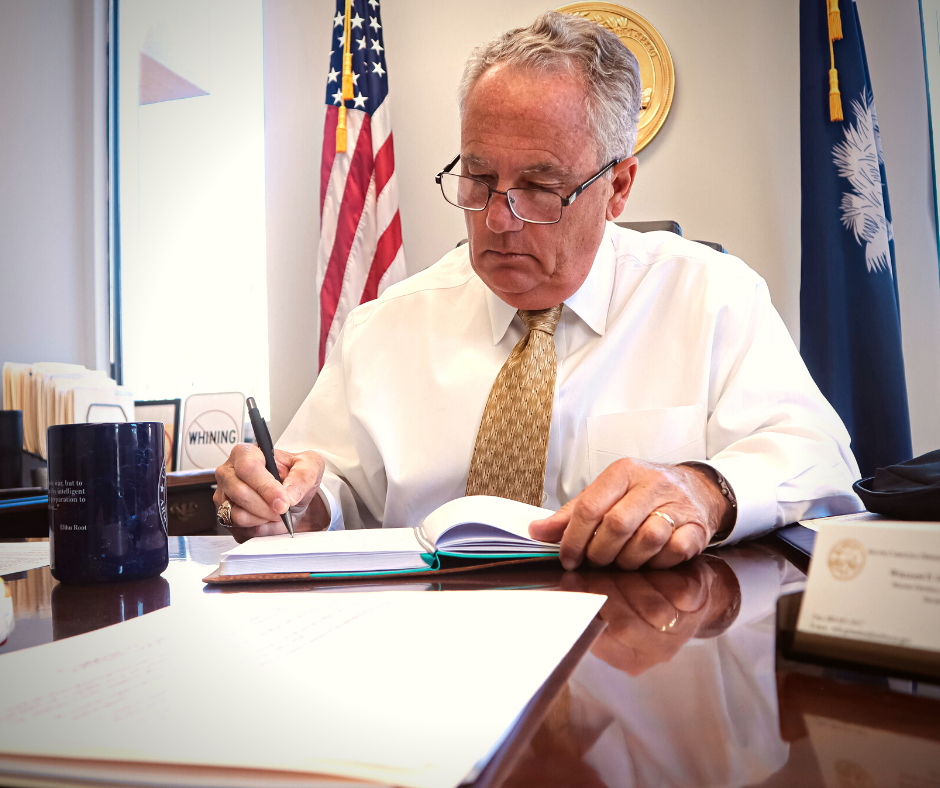

COLUMBIA, SC - On Thursday, February 3rd, Secretary Will Grimsley was honored to testify in front of the Sales, Use and Income Tax Legislative Subcommittee of the House Ways and Means Committee regarding House Bill 3247 - Workforce Enhancement & Military Recognition Act.

COLUMBIA, SC - On Thursday, February 3rd, Secretary Will Grimsley was honored to testify in front of the Sales, Use and Income Tax Legislative Subcommittee of the House Ways and Means Committee regarding House Bill 3247 - Workforce Enhancement & Military Recognition Act.

The subcommittee unanimously passed the amended version of H.3247 as proposed by Rep. Gary Simrill (R-York). This would make the tax exemption on military retiree pay immediate, removing the phase-in and earned income cap option in the bill. The bill now goes to the full House Ways and Means Committee.

Secretary Grimsley believes H.3247 and ANY other legislation that exempts military retirement pay from taxation is critical to our state's military, economy and workforce.

"Today, 35 other states have chosen to fully exempt retirement pay. 12 states, including South Carolina, have partial exemptions. North Carolina recently voted to move from partial to full, and Governor Kemp in Georgia is pushing for the same. We are competing with other states to increase the overall number of Veterans in South Carolina including the retired population...

Taxing retirement pay is a disincentive to relocate or remain in South Carolina...A South Carolinian who enlists today at 18 is retirement-eligible at 38, is very likely to be married, has years of deep experience as a leader, is an expert in his or her field, understands complex systems, knows how to build teams to solve challenges, considers a diverse work force as the norm, and shows up to work on time all the time. The human capital investment in South Carolina is invaluable, but we have got to get them here and keep them here."

Secretary Grimsley also requested the testimony of two military retirees who chose to make South Carolina their home. U.S. Navy Retired Chief Petty Officer, Angela Andrews, who has more than 24 years of active duty service, along with U.S. Army Retired Command Sergeant Major Lamont Christian who served active duty for 30+ years.

"I feel anyone that serves their country for at least 20 years selflessly, should not have their retirement pay taxed. I also support the full exemption of retirement pay, because some retirees may not be able to continue to work and earn other income so, this may be their only source. However, I know for myself that if I did not seek other employment after retiring as an enlisted service member because my family would suffer financially and that is true for many others like myself. Our retirement benefit is a supplement to other income and doesn’t cover the cost of living. That becomes even more true when it is reduced through taxation." - Angela Andrews, Chief Petty Officer (Ret. - US Navy)

"I feel anyone that serves their country for at least 20 years selflessly, should not have their retirement pay taxed. I also support the full exemption of retirement pay, because some retirees may not be able to continue to work and earn other income so, this may be their only source. However, I know for myself that if I did not seek other employment after retiring as an enlisted service member because my family would suffer financially and that is true for many others like myself. Our retirement benefit is a supplement to other income and doesn’t cover the cost of living. That becomes even more true when it is reduced through taxation." - Angela Andrews, Chief Petty Officer (Ret. - US Navy)

"Over the past 12 years of my SC residency as a Soldier and retiree, I have personally observed and experienced the struggle to entice heavily qualified and experienced military retirees to remain in the South Carolina community. Military members progressing into civilian communities will look at property tax, sales tax, tax on military retirement, and cost of living. South Carolina is a leader in most of these areas, yet still behind neighboring Florida and the military dense state of Texas with taxes on military retirement. However, the mere discussion of these bills being considered has military retirees considering relocating from states like Texas and even neighboring Georgia...the passing of this bill will only serve to amplify the message that South Carolina is a state that helps improve the quality of life for service members and military families. Anything beyond this statement will only be redundant in its exhaustive proclamation to pass a tax exemption of military retiree pay bill without hesitation and make this a win/win for all connected to the defenders of our communities, our state of South Carolina and our Nation." - Lamont Christian, Command Sergeant Major (Ret. - US Army)

"Over the past 12 years of my SC residency as a Soldier and retiree, I have personally observed and experienced the struggle to entice heavily qualified and experienced military retirees to remain in the South Carolina community. Military members progressing into civilian communities will look at property tax, sales tax, tax on military retirement, and cost of living. South Carolina is a leader in most of these areas, yet still behind neighboring Florida and the military dense state of Texas with taxes on military retirement. However, the mere discussion of these bills being considered has military retirees considering relocating from states like Texas and even neighboring Georgia...the passing of this bill will only serve to amplify the message that South Carolina is a state that helps improve the quality of life for service members and military families. Anything beyond this statement will only be redundant in its exhaustive proclamation to pass a tax exemption of military retiree pay bill without hesitation and make this a win/win for all connected to the defenders of our communities, our state of South Carolina and our Nation." - Lamont Christian, Command Sergeant Major (Ret. - US Army)

VIDEO of the full testimony can be found online at the State House Video Archives. CLICK the link titled Thursday, February 3, 2022 9:00 am House Ways and Means Committee - Sales, Use and Income Tax Legislative Subcommittee.