COLUMBIA, S.C. - The South Carolina Department of Veterans' Affairs (SCDVA) is in support of state legislators approving a bill that would make military retirement tax exempt in the Palmetto State.

Currently Act 272, passed in 2016, phased-in a partial exemption of military retirement income through 2020. The law states:

- Retirees under 65 may deduct an amount of retirement income equal to SC earned income not exceeding $17,500.

- Retirees 65 and over may deduct retirement income not exceeding $30,000.

Right now, there are several proposals amending this legislation and SCDVA is in support of all. All amendments propose exempting military retirement pay from taxes, but each does it in a different way.

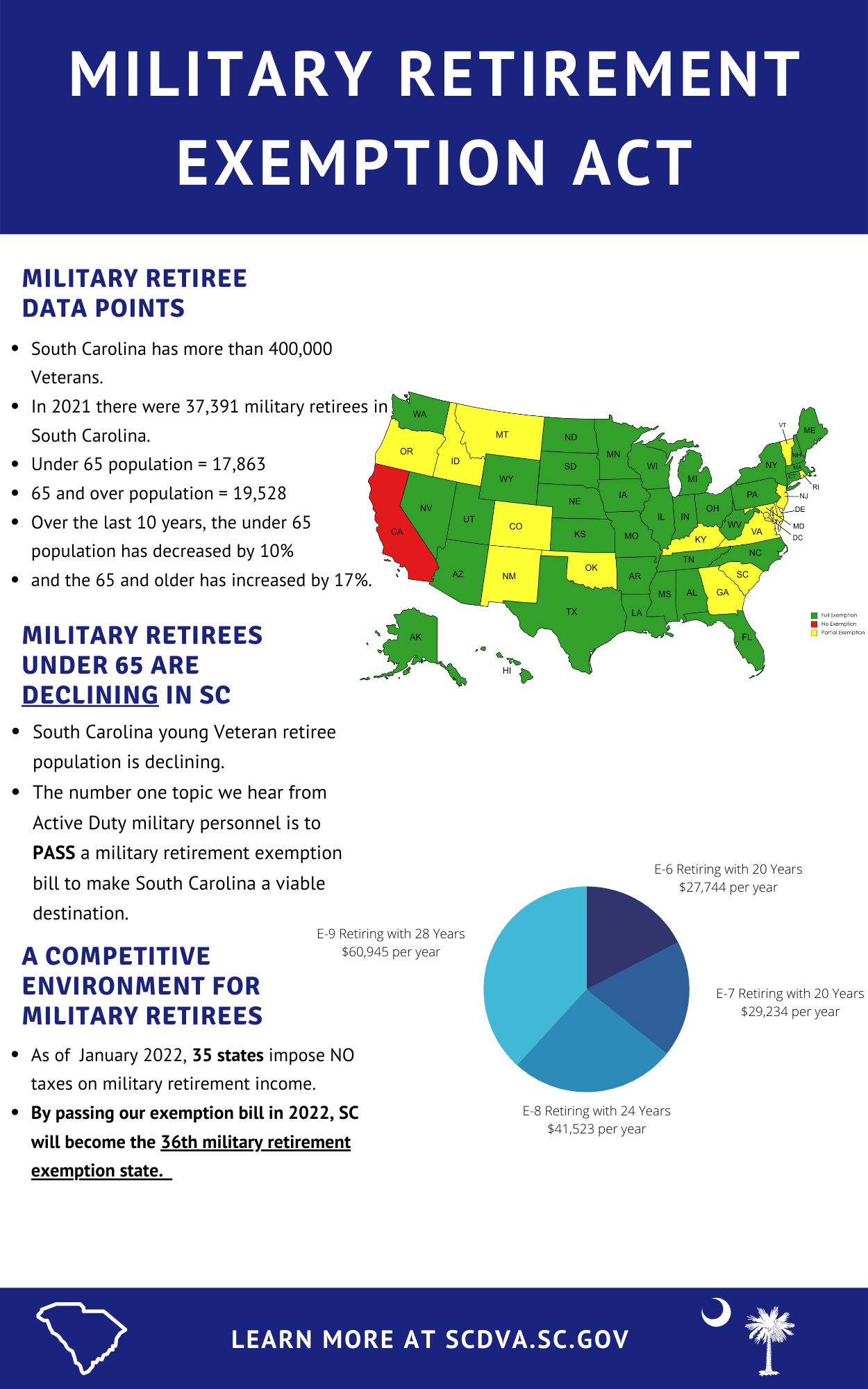

There are more than 400,000 Veterans in South Carolina with more than 37,000 being military retirees (see graphic below). While the senior Veteran population continues to increase, the younger Veteran population continues to decrease. SCDVA, Veterans Service Organizations, state leaders and businesses recognize the critical need for military retiree pay to be fully tax exempt in order to make South Carolina a more competitive state for Veterans to live and work.

Supporting Military Retirees

SCDVA Secretary Will Grimsley has enabled a working group of professionals dedicated to research of initiatives that benefit military retirees and their families in South Carolina. The working group is comprised of leaders within SCDVA and military retirees in our community.

One of the working group members is Lamont Christian, Director of the Warrior PATHH Program at the Big Red Barn Retreat in Blythewood, South Carolina. Christian is a retired Command Sergeant Major who has called the Palmetto State home during his military career and in retirement. Christian, who mentors military service members and Veterans through the Warrior PATHH Program, agrees with other state and military leaders that improved military retirement legislation ultimately shows Veterans they are not only appreciated for their contributions and sacrifice, but it also makes our state a competitive destination to retire.

"There is without a doubt a significant presence of military heritage and service in South Carolina. Many of these service members and their families have made the decision to remain near the last duty station they served, or separate in a community that is as committed to being military friendly. Creating this bipartisan legislative support to fully exempt all military retiree pay from state income tax will send a positive message that South Carolina is indeed a military friendly state and not just promoting a popular buzzword or phrase," says Christian.

"Passing the bill that would make military pensions tax exempt would be a huge win for our Veterans and for the State of South Carolina. Military retirees bring incredible amounts of energy, motivation, and talent to the workforce, and to the local community. Passing this bill would attract retirees in greater numbers to South Carolina..."

SGM (Ret.) Steven Noonan, Director of Training & Standardization

South Carolina Department of Veterans' Affairs

"Passing a Military Retirement Exemption bill in South Carolina has never been more critical. With five additional states passing legislation effective in January, we are not competitive for retaining retiring military personnel in the Palmetto State. South Carolina has the 10th largest density of military personnel in the nation, not including the neighboring talent at Fort Gordon. We must make this an attractive location for our service members to begin their second career in our workforce. Sadly, we have lost 10% of our workforce-aged military retirees over the last ten years."

Dan Beatty, Chairman

SC Military Base Task Force

"South Carolina is not only an inviting place for our military personnel to retire, but also continues to offer economic opportunities for them to continue their extraordinary service but now directly to our state’s economy. And, we need them now more than ever! Recruiting motivated and disciplined service-members into critical-need areas such as cybersecurity and logistics will help South Carolina continue our shake-the-earth activity of economic success."

Susie Shannon, President and CEO

SC Council on Competitiveness

What's Next?

There are multiple versions of similar bills in the General Assembly, with various implementation timelines. The South Carolina Department of Veterans’ Affairs supports a tax exemption on military retirement, whether it is a phased in approach or a full exemption. This is a priority for our department and we will keep you informed of its progress throughout the legislative session.

Be sure to subscribe to our newsletter for continuous updates on news and legislation related to military retirement exemption in South Carolina.